Set Company Taxes

Customize company-wide taxes for your Company Account.

OBJECTIVE

To set Company Taxes in ConstructionOnline.

BACKGROUND

ConstructionOnline's industry leading financial tools help construction companies streamline project financials from start to finish. To maximize ConstructionOnline's powerful financial management system, Company Admin Users can set Company Taxes for your ConstructionOnline Company Account. Once set, Company Taxes can be quickly selected for use within project financials—creating a more efficient and easy-to-use project experience.

THINGS TO CONSIDER

- Company Taxes are used for company-wide financials and can be accessed and viewed by all Company Employees added to the Company Account.

- Only Company Admin Users can edit Calculation Method & Tax Settings or add a new Tax Type.

- All Company Employees can edit existing Tax Types.

- Any changes made to Company Taxes will apply company-wide.

- If Company Taxes are changed after a Company Project is created, project financials will not reflect the changed Company Taxes.

- Company Taxes cannot be set from the ConstructionOnline Mobile App.

STEPS TO SET COMPANY TAXES

- Locate the Company Dropdown Menu found in the top right corner of ConstructionOnline.

- Under Financial Settings, select Company Taxes.

- Using the dropdown menus, select a Calculation Method and Tax Setting.

- Calculation Method: default tax and markup methods for Company Project financials.

- Tax then Markup

- Markup then Tax

- Tax and Markup Separate

- Tax Setting: default tax settings for Company Project financials.

- United States

- Canada

- Australia

- United Kingdom

- Other

- Calculation Method: default tax and markup methods for Company Project financials.

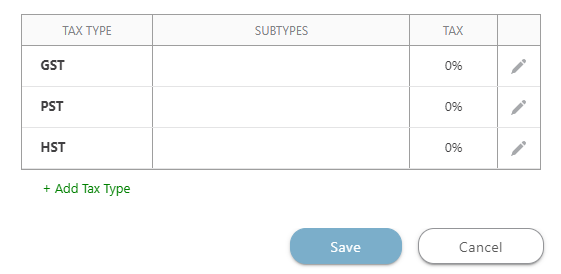

- To add a new tax type, click the green + Add Tax Type button.

- Type the tax type name in the Name text field. This is a required field.

- Enter the tax percentage in the Tax (%) text field. If no value is entered, the tax percentage will default to 0%. If subtypes are added, the total tax percentage will always equal the sum of the subtype tax percentages.

- To add an optional tax subtype, click the green Add Subtypes button.

- Type the tax subtype name in the provided text field. This is a required field.

- Enter the tax percentage in the Tax (%) text field. If no value is entered, the tax percentage will default to 0%.

- Click the blue Save button.

- Click the second blue Save button finalize your changes.

TIPS & TRICKS

- Additional customizations to tax types and subtypes are possible!

- Edit a tax type name or total percentage: locate the desired tax and click the grey pencil icon.

- Remove a tax type: after clicking the pencil icon, click the red Delete button.

- Remove a subtype: after clicking the pencil icon, click the red X icon next to the corresponding subtype.

- Remember to click the blue Save button after any changes are made to Company Taxes!

HAVE MORE QUESTIONS?

We're here to help! Chat with a Specialist by clicking the orange Chat icon in the bottom left corner or Contact UDA Support for additional options.