Apply Tax to an Estimate Item

Apply taxes from Estimate Tax Settings to individual Estimate Line Items on a construction estimate.

BACKGROUND

Using the powerful, integrated estimating tools of ConstructionOnline's OnCost™ Estimating system, ConstructionOnline™ Company Users can create detailed, accurate construction cost estimates with ease & efficiency. With flexible Estimate Tax Settings, Company Users can customize the tax method, types, and rates for each individual Estimate in ConstructionOnline. When it's time to add tax to individual Estimate Lines*, Company Users can use the Tax Type column of the Estimate to automatically calculate tax values.

PREREQUISITES

- To apply tax to an Estimate Item, Estimate Tax Settings must already be set with the desired tax calculation method, tax types, and tax rates. Step-by-step instructions to edit existing Tax Settings can be found in Set Estimate Tax Settings.

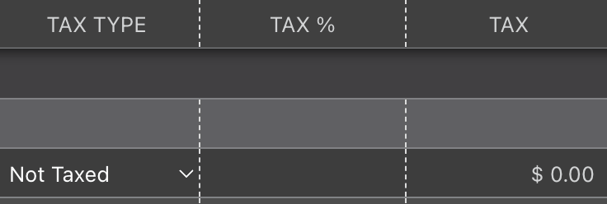

- The Tax Type, Tax %, and Tax columns of your Estimate must be visible to apply tax to an Estimate Item.

- The tax columns are included by default in the Advanced Estimate and Budget estimate column views. More instructions for displaying hidden Estimating columns can be found in Show/Hide Estimate Columns.

STEPS TO APPLY TAX TO AN ESTIMATE ITEM

- Locate the desired Project via the Left Sidebar.

- Select the Financials tab, which will automatically open the Estimating category.

- Select the corresponding tab for your desired Estimate Category, then locate the specific Estimate Item.

- After locating the specific Estimate Item, use the horizontal scroll bar to find the Tax Type column.

- Use the provided dropdown menu to select the desired tax type.

- Once a tax type has been selected, ConstructionOnline will automatically calculate the total tax for the Estimate Item with the selected tax type and subsequent tax percentage. The total calculated tax for the Estimate Item will be stored in the Tax column.

ADDITIONAL INFORMATION

- In a 3-Level Estimate, tax can only be applied to individual Estimate Items. Tax cannot be applied to individual Subcategories or Categories; instead, ConstructionOnline will display the total calculated tax from any applicable Estimate Items.

- In a 2-Level Estimate, tax can only be applied to individual Estimate Subcategories. However, 2-Level Estimates are not compatible with the majority of ConstructionOnline's other financial features. For complete compatibility with all of ConstructionOnline's financial tools, Standard 3-Level Estimates are the recommended best practice.

- Only one tax type can be selected per Estimate Item.

- Permissions: To apply tax to an individual Estimate Item, Company Users must have Estimating Permissions set as "Can Create, Edit, & Delete".

- If Estimate Tax Settings are altered AFTER tax has been applied to an individual Estimate line, the calculated tax for the Estimate line will automatically update based on the new tax settings.

- Mobile App: Applying tax to Estimates is exclusively available via browser access to ConstructionOnline. Estimates are presented in View-Only Mode on the ConstructionOnline Mobile App.

HAVE MORE QUESTIONS?

- Frequently asked questions (FAQ) regarding OnCost Estimating can be found in the FAQ: Estimating article.

- If you need additional assistance, chat with a Specialist by clicking the orange Chat icon located in the bottom left corner or visit the UDA support page for additional options.